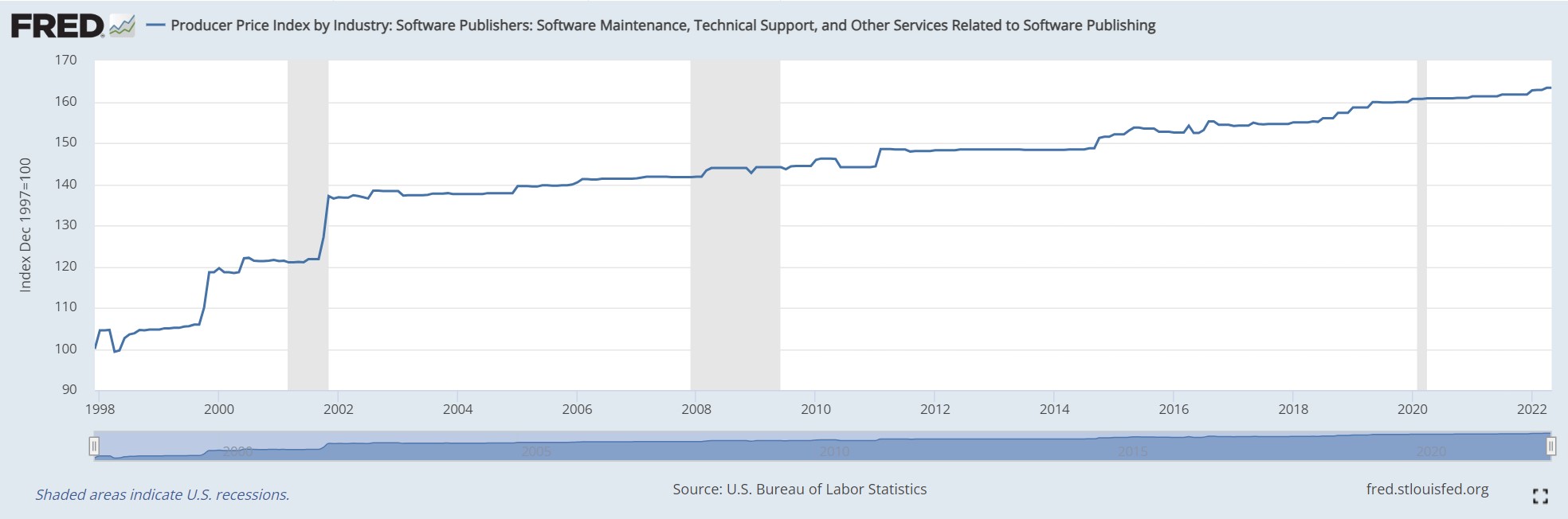

Many companies have felt the impact of rising costs and inflation first-hand, especially over the last 18 months. During this time software prices have increased by 10-30% which is much higher than the standard 3-5% per annum CPI increase that companies expect and budget for. These rises have been caused largely by inflation and interest rates as well as uncertainty in the market due to events such as the Russian invasion of Ukraine and, to a lesser degree now, Covid-19. In the last 12 months to June 2022, the CPI rose by 6.1% (abs.gov.au).

It is important that IT and finance departments can prepare and pivot for these price hikes and manage their costs effectively.

https://fred.stlouisfed.org/series/PCU511210511210504

As a starting point, the below should be understood when managing cost increases so strategies can be implemented to mitigate the impact:

Understand the product

- What is the use case of the software being purchased or renewed?

- Understand what functionality the software provides, and if the total functionality is required and being utilised.

- How many users are licensed?

- Know how many users will be impacted by any changes. Is it a small team or enterprise-wide?

- What is the criticality of the software within the business?

- Does this software impact/manage any critical infrastructure such as operational technology or cyber security? Understand the business impact of any changes to the software.

- What alternative applications could be used if any?

- Is it a viable option to replace the existing software with a cheaper alternative?

- Is the software bespoke or off-the-shelf?

- Are there any integrations that would cause challenges if the software is substituted for a more cost-effective option?

Understand the justification behind the cost increase

- Does the cost increase come from economic factors such as inflation, interest rates, labour/resourcing costs, energy, materials and/or logistics?

- If the costs are increasing in line with economic changes, there may be minimal negotiating power. However, if the costs are significantly larger, then this should be explored further to determine if this can be negotiated down.

- Has the software had new features/support or change in licensing model?

- Many software vendors are moving from perpetual licensing models to subscription and SaaS, which can have a larger total cost of ownership (TCO) over the life of the software.

Ensure there are strong internal asset management systems and teams in place

Without having a good understanding of the overall IT environment and existing software portfolio, it can be hard to pinpoint areas of optimisation and cost savings/avoidance opportunities. Having a Software Asset Management team in place with key asset management systems such as Flexera and ServiceNow will ensure your company is best placed to take a proactive approach in reducing costs and managing consumption.

Know your leverage

As most companies have experienced, trying to negotiate costs down with large software vendors such as Microsoft and Oracle is almost impossible, so rather than taking this approach it is best to be on top of licensing compliance and optimisation internally. This goes back to having a strong Asset Management team in place ensuring this is being monitored closely. For other vendors, the best approach may be to negotiate pricing at time of purchase or renewal to get the best deal possible for the year/s ahead and reduce the budget impact.

Rising costs due to inflation and interest rates is something that will be an ongoing challenge within all areas of business, and it is important to understand what can be done to proactively manage the risk.

If you would like to hear more information about how your company can manage their software assets and reduce overall software spend, please reach out to us via email at info@tmg100.com